Law of Supply and Demand

The law of supply and demand is a theory that explains the interaction between the supply of a resource and the demand for that resource. Demand refers to how much (quantity) of a product or service is desired by buyers. The quantity demanded is the amount of a product people are willing to buy at a certain price. As an example, when the price goes down for a pound of meat, quantity consumers buy will increase (because more people now afford to buy meat).

Supply represents how much the market can offer. The quantity supplied refers to the amount of a certain good producer are willing to supply when receiving a certain price. Hence, low supply and high demand increase price. In contrast, the greater the supply and the lower the demand, the price tends to fall.

Marginal Utility

Marginal utility is the additional satisfaction a consumer gains from consuming one more unit of a good or service. Marginal utility is an important economic concept because economists use it to determine how much of an item a consumer will buy. So utility is really just a way of saying how much benefit or satisfaction or value do you get out of getting a good or service. As an example, what’s the marginal utility of getting one chocolate bar verses to get the utility of getting a second one or third one or the fifth one? But how do economists actually calculate marginal utility? Or assign a “figure” to the level of “satisfaction”? Or how can we know the MU from first chocolate bar to the second drops 20% and not 30% for instance? The answer is that the marginal utility is different for each person. It is not a value that you can read in a table somewhere. If you are looking at a group of people that are allergic to a chocolate bar then their marginal utility will be different than yours for example. But you can conduct surveys and statistically say things like “The average English 18-year-old boy has a utility function that looks like this much.

Gross Domestic Product (GDP)

GDP represents the monetary value of all goods and services produced within a nation’s geographic borders over a specified period of time. Hence by definition: GDP is the final value of the goods and services produced within the geographic boundaries of a country during a specified period of time, normally a year. GDP growth rate is an important indicator of the economic performance of a country.

The question is then is does High GDP Mean Economic Prosperity? The answer is If GDP is rising, the economy is in good shape, and the nation is moving forward. If GDP is falling, the economy is in trouble, and the nation is losing ground.

The Gross Domestic Product (GDP) in the United States, India and Germany are $18.57, 2.264 and 3.467 trillion USD respectively in 2016.

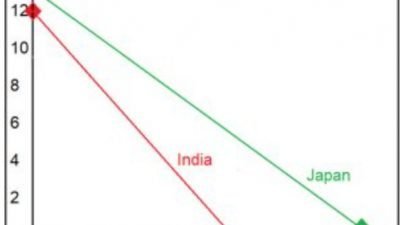

Economic Growth Rate

source: www.Investopedia.com

For investors, Economic Growth Rate represents the compounded annualized rate of growth of a company’s revenues, earnings, dividends or even macro concepts such as gross domestic product (GDP) and retail sales. Economic Growth Rate does not adjust for inflation.

Inflation

Inflation is defined as a sustained increase in the general level of prices for goods and services in a county and is measured as an annual percentage change. When the price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money. An under-inflation condition, the prices of things rise over time because as inflation rises, every dollar you own buys a smaller percentage of a good or service. When prices rise, and alternatively when the value of money falls that means you have inflation.

Business cycle

The business cycle describes the rise and fall in production output of goods and services in an economy. The business cycle describes overall trends in GDP. It shows how economies can swing. From high economic growth to negative growth and then back. Economic growth is about expansion in national output (GDP). Four stages of the Business Cycle:

- Boom

- Recession

- Slump

- Recovery

In Boom time stage, demand for goods and services and levels of “production” is “high”. Consumer “confidence” to spend money is high.

In a “Recession stage”, unemployment increases, which causes less spending by consumers, which causes further job losses.

In a slump stage (or depression), many firms will go out of business. Consumer demand is very low and unemployment is very high. The worst depression of the last 100 years was the “Great Depression” in the 1930s. The US economy declined in size by almost 14% in 1932 alone.

In “Recovery stage”, output (GDP) begins to rise. Rising demand means that firms hire more labor. Which increases consumer confidence which causes increases in demand.

Interest rate

Interest is money that you pay to keep the money for some period of time. For example, let’s say that I want to borrow $4000 from a bank. The bank might tell me that “I am willing to give you 4000 now if you give me $4480 a year later. So in this situation, how much extra am I going to pay to keep that $4000 for a year? In this situation, I am going to pay $480 more to keep the money for one year. So, the fee that I have to pay the bank to keep that money and do whatever I want with that money, and maybe save it, maybe invest it, do whatever for a year. That $480 is essentially the interest. And a way that it is often calculated as a percentage of the original amount that I borrow. And the original amount that I borrow, infancy banker or finance terminology is just called the principal. So, in this case, the rent on the money or the interest is $480. And if I want to do it as a percentage, I would say $480 over the principal is equal to 12%. So then after a year, I will owe the bank $4000 plus 12% times $4000 and that is equal to $4480.